Contents

- Visa CEDP & Product 3 Explained: The Complete Merchant Guide

- Quick Answer: What Visa’s Product 3 Really Is

- 1. How CEDP Works: The Framework

- 2. Technical Data Requirements & Logic

- 3. The Hidden Operational Change

- 4. Technical Troubleshooting: CEDP Error Codes

- 5. Cost, Margins, and Cash Flow

- 6. Visa CEDP Product 3 FAQs

- About IntelliPay

Visa CEDP & Product 3 Explained: The Complete Merchant Guide

By Dale Erling |15+ Year Payment Strategist | 10 Minute Read

Last updated January 2026

Quick Answer: What Visa’s Product 3 Really Is

Visa’s Commercial Enhanced Data Program (CEDP) replaces legacy Level 2 and Level 3 structures with a new Product 3 interchange model. This program rewards merchants who submit accurate, invoice-level data on commercial and government card payments. For small businesses, this means your card costs now depend on whether your payment stack can automatically send clean line-item details with every transaction.

1. How CEDP Works: The Framework

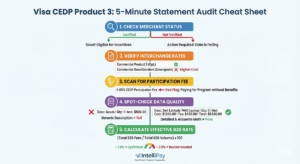

At a high level, CEDP replaces the old Level 2 and Level 3 programs with a single enhanced data framework. Instead of separate “levels,” Visa uses a scoring and validation model that assigns merchants a status of Verified or Not Verified based on the quality of the data they send.

Verified Status: Qualifies you for lower Product 3 interchange incentives.

Not Verified Status: You do not qualify for incentives, and transactions route to higher-cost base categories.

The Fee: Visa applies a 0.05% participation fee on applicable commercial transactions that include enhanced data. This fee is typically passed on at the payout stage.

2. Technical Data Requirements & Logic

To achieve a “Verified” status and maintain Product 3 pricing, your payment data must follow strict network logic:

- The “Source Amount” Math: Your total transaction amount must equal the aggregated value of:Line Item Totals + Tax(es) + Shipping – Discounts.

Data Persistence: If you provide Product 3 data during an “Auth Only” request but not during the “Capture,” the data from the Authorization persists. However, if you provide different data in both, the Authorization data is ignored in favor of the Capture data.

Prohibited Characters: Do not include the pipe character ( | ) in any property value, as it can cause transaction failures or data truncation.

Required Units of Measure: For specific purchase types (Fuel/Service), you must use Visa-standard codes: L (Liters), G (Gallons), I (Imperial Gallons), K (Kilograms), P (Pounds), C (Cubic Meters), or W (Weight).

3. The Hidden Operational Change

CEDP is more than a pricing update; it is a workflow change. In a pre-CEDP world, businesses could get by with partial data or generic placeholders. In the Product 3 world, Visa uses AI-based monitoring to detect “junk data” (e.g., zero tax where it should apply or generic product codes).

Common “Junk Data” Triggers to Avoid:

Line-item descriptions that are identical to the merchant name.

Generic descriptions like “Service” or “Product” that provide no detail on what was purchased.

Single-character descriptions or placeholders like “…”.

Use this 5-minute cheat sheet to quickly audit your merchant statement for Visa CEDP Product 3 compliance and identify potential cost-saving opportunities.

4. Technical Troubleshooting: CEDP Error Codes

If your data is missing or incorrect, Visa returns specific error codes. Use this table to troubleshoot why your transactions are being downgraded from Product 3 rates.

| Error Code | Description / Required Fix |

| CS-0004/05/06 | Local Tax Error: Tax Included must be “1” if a tax amount is provided, and “2” if no tax is provided. |

| CS-0011 | Amount Mismatch: Total amount does not equal the sum of line items, tax, and shipping. |

| TC50-1001 | Blank Description: Item description must not be blank, null, or zeros. |

| TC50-1004 | Line Item Math: Line item total must equal (Unit Cost x Quantity) - Discount. |

| TC50-2002 | Merchant Name Conflict: Description is too similar to the merchant name. |

| TC50-2004 | Generic Data: Description provides no meaningful detail on the purchase. |

5. Cost, Margins, and Cash Flow

The most obvious impact of CEDP is cost. When a business consistently sends high-quality data, Product 3 interchange categories can reduce effective costs on commercial and government payments by 1.0%–1.5% compared to downgraded base rates.

However, if your data is incomplete, you absorb the 0.05% participation fee without receiving any of the interchange benefits—essentially paying for a program you aren’t using.

6. Visa CEDP Product 3 FAQs

Q: Does Product 3 apply to all commercial cards?

A: Yes. Corporate, Purchasing, and now Business Credit cards are all eligible for Product 3 rates. Previously, Business Credit cards only qualified for Level 2.

Q: How long does it take to become “Verified”?

A: Visa verifies businesses on an ongoing basis, but it can take up to three months for your status to update once you start submitting high-quality line-item data.

Q: What happens if I don’t know the card type?

A: If you are unsure if a card is eligible, pass as many Product 3 (Level 3) properties as possible. If the card does not support enhanced data, the network will simply ignore the extra fields.

About IntelliPay

We help merchants optimize their payment processing through transparent interchange-plus pricing, reliable technology, and expert guidance on network programs like Visa CEDP. Contact us for a Free Statement Audit to see if your transactions are currently qualifying for Product 3.

Disclaimer: This article is for informational purposes only. Visa CEDP rules and 2026 interchange rates are subject to network updates. Review your specific processing setup with a qualified payments professional.