Contents

- NACHA 2026: Moving Beyond Account Validation to Proactive Fraud Monitoring

- Executive Summary: The 2026 Nacha Mandate

- Key 2026 NACHA Updates:

- What Are the March 20, 2026 Nacha Rule Changes for ACH Merchants?

- How Does the New Rule Combat “Credit Push” and Identity Fraud?

- Comparison: ACH Compliance Standards (Old vs. New)

- What Are “Standardized Entry Descriptions” and Why Are They Required?

- Frequently Asked Questions (FAQs)

- Q: Does this rule apply to small businesses?

- Q: What is “False Pretenses” fraud?

- Q: Will my bank (ODFI) provide the monitoring tools?

- Glossary of 2026 NACHA Terms

- Additional Reading

NACHA 2026: Moving Beyond Account Validation to Proactive Fraud Monitoring

By Dale Erling | 15+ Year Payments Strategist & Compliance Expert Fact-Checked & Reviewed By: Jess Hunt, AAP | Risk Manager, IntelliPay Last Updated: January 9, 2026 | 6 Minute Read

Executive Summary: The 2026 Nacha Mandate

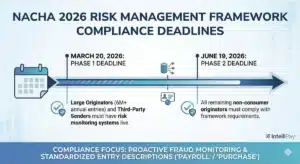

As of March 20, 2026, Nacha has officially shifted the compliance burden from simple account verification to continuous fraud monitoring. The “Risk Management Framework” now requires merchants to identify transactions initiated under False Pretenses—specifically targeting Credit Push fraud and Business Email Compromise (BEC). This update is a phased rollout, impacting large originators in March and all remaining businesses by June 2026.

Key 2026 NACHA Updates:

Deadline: Phase 1 (March 20), Phase 2 (June 19).

Requirement: Transition from simple account validation to proactive identity/fraud monitoring.

File Changes: Mandated use of “PAYROLL” or “PURCHASE” in ACH entry descriptions.

What Are the March 20, 2026 Nacha Rule Changes for ACH Merchants?

The 2026 amendments eliminate the legacy “commercially reasonable” standard in favor of a mandate for Adequate Control Systems. Previously, validation focused on ensuring an account was “open and valid.” Now, originators must implement processes intended to verify that the payee identity matches the account ownership.

Direct Answer: The primary change is the requirement for “proactive monitoring” of all ACH entries to detect fraud patterns before they are sent, specifically focusing on identity verification and standardized file descriptions.

Don’t miss the deadlines. This timeline outlines the phased roll-out of the 2026 Nacha Risk Management Framework, requiring merchants to implement proactive fraud monitoring and standardized ACH entry descriptions by March and June 2026

How Does the New Rule Combat “Credit Push” and Identity Fraud?

Traditional validation was reactive. The 2026 framework is predictive. By requiring merchants to monitor for anomalies (such as sudden changes in vendor bank details or unusual payroll velocity), Nacha is forcing a move against the “Identity Tax.”

The Identity Tax is the hidden cost merchants pay when synthetic IDs or deepfakes bypass legacy checks. Under the new rules, if your system does not flag a “Credit Push” entry that deviates from historical patterns, your business may face increased scrutiny from your ODFI (Originating Bank).

Comparison: ACH Compliance Standards (Old vs. New)

| Feature | Legacy Standard (Pre-2026) | 2026 Nacha Mandate |

| Validation Goal | Account is “Open & Valid” | Identity & Account Ownership |

| Fraud Type | Unauthorized Debits | False Pretenses & Credit Push |

| Monitoring Level | Occasional/Point-of-Sale | Continuous/Lifecycle |

| File Descriptions | Flexible/Generic | Standardized (“PAYROLL”/”PURCHASE”) |

What Are “Standardized Entry Descriptions” and Why Are They Required?

To help the banking network (RDFIs) identify and stop fraud faster, Nacha now mandates specific terms in the “Company Entry Description” field.

PAYROLL: Must be used for all salary, wage, and compensation credits.

PURCHASE: Must be used for e-commerce WEB debits and consumer purchases.

Using vague descriptions like “Service” or “Bill Pay” for these transactions is now a compliance violation. This standardization allows AI-driven bank filters to instantly recognize if a “PAYROLL” entry is suddenly going to a high-risk offshore account.

Frequently Asked Questions (FAQs)

Q: Does this rule apply to small businesses?

A: Yes. While Phase 1 (March) targets high-volume originators, Phase 2 (June 19, 2026) applies to all non-consumer originators, regardless of size.

Q: What is “False Pretenses” fraud?

A: This is when a legitimate user is tricked into authorizing a payment to a fraudster (e.g., a fake invoice change). The new rules require you to have systems that can flag these “authorized” but fraudulent entries.

Q: Will my bank (ODFI) provide the monitoring tools?

A: Some may, but the liability for “Adequate Controls” sits with the Originator (the merchant). Using a dedicated partner like IntelliPay ensures your monitoring is automated and compliant out of the box.

Glossary of 2026 NACHA Terms

ODFI: Originating Depository Financial Institution (The Merchant’s Bank).

RDFI: Receiving Depository Financial Institution (The Payee’s Bank).

Credit Push Fraud: Tricking a victim into sending money to a fraudulent account.

Adequate Control Systems: Mandated risk-based processes used to detect suspicious transaction patterns.

Additional Reading

The information provided in this guide is for informational purposes only and does not constitute financial, legal, or professional advice. Payment processing regulations, including the 2026 Nacha Risk Management Rules, are subject to change. Seek independent professional guidance before making strategic business decisions.