Why ACH is Right For your Business

ACH or the Automated Clearing House (ACH) Network is an electronic funds-transfer system run by NACHA, formerly the National Automated Clearing House Association. This payment system deals with 100 million payroll, direct deposit, tax refund, consumer bill, tax payment, among other transactions daily in the United States.

Traditionally business to business payments has been via paper check. Advancements in payment processing and accounting systems have made it more accessible for companies of all sizes to receive electronic payments. The network powering those transactions is ACH. ACH provides a way for businesses to transact business without checks. ACH is a faster, more cost-effective, and efficient way to send and receive payments.

Business to Business transactions differs from consumer retail transactions in that they don’t need to happen in real-time. One business will grant another business a defined time before payment is due. Also known as trade credit or terms, trade credit can be costly and burdensome. Accepting credit cards for business payments has its challenges in terms of processing fee costs and settling and reconciling accounts.

ACH costs less than other payment forms like credit cards due to the batch nature of how the payments are processed. An ACH payment is batched and processed with other ACH transactions eliminating the extra costs associated with on-demand transactions. The ability to schedule automatic payments and withdrawals gives businesses more control over the process, which is another benefit of ACH payments.

Types of ACH Transactions

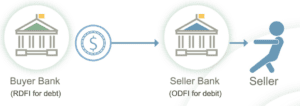

To discover how ACH can benefit your business, we need to understand the types of ACH transactions. The two basic types of ACH transactions are ACH Credits – where the funds are going and ACH Debits – the account where the money originates.

For a business to make an ACH payment to another business, the payer must know the banking account and routing numbers of the payee. A small business might not want to give this information away.

For smaller businesses, ACH debits make more sense. With ACH debits, your customers give you their bank information with a one-time authorization to process pay or an approval for a specific amount for recurring transactions.

ACH debits

Source: NACHA

The requesting business needs to have an ACH merchant account from a bank or third-party provider. A third-party provider processes ACH payments and deposits into your business bank account.

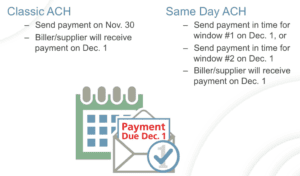

It’s All About Timing

ACH aka classic ACH payments settle within 1-2 days to process, and according to NACHA, most payments settle the next business day. Same-day ACH introduced in the first quarter of 2019 extends the acceptance window for ACH Originators (over 10,000 banks or financial institutions) and fund the same-day.

Source: NACHA

A Closer Look at Same-Day ACH

According to NACHA rules, here is how Same-Day ACH works:

“Originating financial institutions (ODFIs) will be able to submit files of same-day ACH payments through two new clearing windows provided by the ACH Operators (Note: The actual ACH Operator schedules are not determined by the NACHA Operating Rules.):

- A morning submission deadline at 10:30 AM ET, with settlement occurring at 1:00 PM.

- An afternoon submission deadline at 2:45 PM ET, with settlement occurring at 5:00 PM.

Virtually all types of ACH payments, including both credits and debits, will be eligible for same-day processing. Only international transactions (IATs) and high-value transactions above $25,000 will not qualify. Eligible transactions account for approximately 99 percent of current ACH Network volume.”

As mentioned earlier, ACH transactions have a fee. There is one fee for classic ACH transactions and a fee for Same-Day ACH transactions. The Same-Day ACH NACHA rule has a built-in surcharge that the ODFI pays to the RDFI (bank receiving the funds). NACHA does not set or regulate any fees charged to businesses. The cost to send and receive Same-Day ACH payments is determined by your company’s bank.

As a business owner, you will need to weigh the costs between a classic ACH payment with 1-2-day processing versus the same-day funding of Same-Day ACH.

Summary

Key take ways about classic ACH and Same-Day ACH:

Same-Day ACH credit is an efficient way for a business to pay another business

Same-Day ACH costs less than other payment models

ACH debit is a great solution for small businesses

Planning and a good partner help businesses take full advantage of the opportunities and benefits of Same-Day ACH

IntelliPay helps small businesses take full advantage of all the benefits of ACH with none of the hassle. To learn more about how IntelliPay intelligent payment platform can work for you, contact sales@intellipay.com or call 855-872-6622.