Contents

- What Business Owners Should Know About Credit Card Surcharges (2025)

- What is surcharging? A simple definition

- The benefits and drawbacks of surcharging

- What are the pros (benefits)?

- Lower costs

- Other convenient payment methods lower the final cost

- The cons or drawbacks

- Your sales could take a hit.

- It can impact customers’ perception of your business

- It only works for credit cards.

- It can complicate your accounting.

- Legal and card brand requirements (as of March 7, 2025)

- States with outright prohibitions:

- States with surcharge regulations:

- States that recently changed

- Card brand rules: Visa, Mastercard, and Amex

- Important considerations:

- Compliance checklist for merchants

- Penalties for non-compliance

- Should your business add surcharges?

- Further Reading

- About IntelliPay

What Business Owners Should Know About Credit Card Surcharges (2025)

March 7, 2025 Update

If you’re a business owner selling to consumers, you know how expensive credit card fees are. You could pass the credit card fee on to customers to reduce costs since they benefit from the rewards and points. However, it isn’t as simple as adding a fee to each credit card sale. There are rules and laws governing surcharges, also known as added fees, and this guide explains credit card surcharging, including how it works and how it might benefit your business.

What is surcharging? A simple definition

In its most basic form, a credit card surcharge is an additional fee that a merchant charges a customer for using a credit card to make a purchase. It’s important to distinguish this from a convenience fee, which can only be charged for alternative payment channels outside your customary payment methods. For example, if you only accept credit cards, you cannot charge a convenience fee if 100% of your credit card sales are in-person or card-present.

A credit card surcharge is:

- a percentage fee added to the final transaction total when a consumer uses a credit card at checkout

- used only to offset the cost of credit card processing

- added to eligible Visa, Mastercard, Discover, and American Express Opt Blue credit card sales as an itemized line item at checkout

The benefits and drawbacks of surcharging

When considering whether to pass credit card processing fees to your customers, you must understand the pros and cons of surcharging.

What are the pros (benefits)?

Credit card surcharging offers two significant benefits:

Lower costs

If your business absorbs the processing fee on credit card sales, credit card processing is often the highest expense after labor. Consider this example. A small business has an average sale of $25 and is paying 2.9% + $0.30 on each credit card sale; that business is paying $1.03 in swipe fees alone. Imagine if that business did 3,000 transactions, a $3,090 expense, which could be eliminated with surcharging.

Other convenient payment methods lower the final cost

When you show your customers, they have payment options that don’t incur high processing fees. You’ll enhance the customer experience by helping them see that they get a lower final purchase price when using cash or debit cards.

The cons or drawbacks

Like most things in life and business, surcharging has its pros and cons to consider.

Your sales could take a hit.

Conventional business wisdom suggests that a price increase typically leads to lower sales. With surcharging, you are not raising prices but shifting the cost to those who pay with a credit card. A survey of 2,500 consumers found that of consumers choosing not to pay the surcharge, 71% defaulted to cash. Generation Z cardholders used debit cards 72% of the time, as have 53% of millennial cardholders and 51% of bridge millennial cardholders.”

The same survey found that eighty-five percent of those who faced surcharges agreed to pay them.

If merchants in your industry include a credit card surcharge on sales, you would likely see only the cost-benefit. However, if your industry and competition absorb credit card processing fees, adding a surcharge to your customers could reduce your competitiveness.

It can impact customers’ perception of your business

Customers may prefer not to pay an extra fee to use a credit card.

It only works for credit cards.

Surcharging is only for credit card transactions. Debit and prepaid card transactions cannot be surcharged.

It can complicate your accounting.

One reason adding surcharges increases accounting complexity is that they don’t appear on statements. So, you or your accountant would need to review each card transaction to see which has a surcharge. Another is processing fees, ranging from 1.3% to 3.5%.

Legal and card brand requirements (as of March 7, 2025)

As of March 2025, several states have laws prohibiting or regulating credit card surcharges. It’s crucial to know these restrictions to avoid potential penalties. Here’s the breakdown:

States with outright prohibitions:

Texas: While federal courts have ruled against Texas’s surcharge laws in the past, the Attorney General has issued an opinion stating that the law is enforceable. Proceed with extreme caution.

States with surcharge regulations:

Colorado: Allows credit card surcharging up to 2%.

New York, New Jersey, Nevada, and South Dakota: Surcharges may not exceed the merchant’s actual cost to accept the card. (See also Visa merchant surcharge rules.)

States that recently changed

Kansas: Effective January 2025, Kansas now allows surcharging.

It’s important to note that the legislative intent in many states was to protect consumers, not to restrict B2B surcharging. Therefore, B2B companies may have exceptions. Contact an attorney if you are a B2B company and wish to surcharge in every state.

Minnesota: As of January 1, 2025, credit card surcharging is legal if the customer can reasonably avoid the fee (e.g., by paying cash). Mandatory fees must be included in the advertised price unless the consumer can reasonably avoid them.

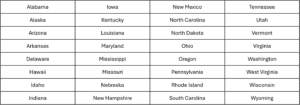

States that permit credit card surcharging

Card brand rules: Visa, Mastercard, and Amex

Beyond state laws, the card networks (Visa, Mastercard, American Express) have their own rules regarding surcharging. Historically, compliance with Visa’s rules often means compliance with other brands, but it’s essential to understand each network’s specific requirements.

Here’s what the card brands agree on for surcharging:

- The surcharge must be limited to your Merchant Discount Rate (MDR) for the applicable credit card or 3%, whichever is lower. MDR is the fee you pay to your acquirer or service provider for processing a credit card transaction, and it typically includes all the fees on your merchant statement EXCEPT PCI compliance, terminal rental fees, or any other special fee that is not paid via the per-transaction merchant discount fee mechanism.

- The surcharge must be submitted separately from the transaction amount in the authorization and clearing message.

- The receipt must list the surcharge amount as a separate line item.

- If the original transaction is partially or fully refunded, the surcharge amount must be refunded proportionally.

- Surcharging debit or prepaid cards is prohibited for all merchants.

- Any surcharge amount, if allowed, must be included in the Transaction amount and not collected separately.

Important considerations:

Maximum Surcharge Cap: While Mastercard’s cap remains at 4% in 2025, Visa’s maximum surcharge cap is currently 3%, effective April 15, 2023.

Cost-Based Surcharging: Surcharging should cover costs, not generate profit. Charging a flat rate (e.g., 3.5% or 4%), regardless of your actual processing costs, can violate card acceptance rules, especially for B2B companies with lower effective rates.

Compliance checklist for merchants

To implement surcharging compliantly, follow these steps:

Notify your processor/acquirer: You must notify your acquirer (credit card processor) at least 30 days before you begin surcharging. Indicate whether you will surcharge at the brand level or product level.

VISA

https://www.visa.com/merchantsurcharging

Mastercard

https://www.mastercard.us/en-us/business/overview/support/merchant-surcharge-rules.html

Note: Discover and Amex do not require notification.

Disclose Surcharges

For card-not-present orders (telephone or online), disclose the surcharge verbally (for telephone orders) or in a clear, conspicuous font (minimum 10-point Arial) for online orders.

Retail locations: Display signage at the entrance and point of transaction. The font size must be prominent (minimum 32-point Arial at the main entrance and 16-point Arial at each checkout). Example: “We impose a surcharge on credit cards that is not greater than our cost of acceptance. We do not surcharge debit cards.”

Provide Clear Receipts: Deliver receipts with the surcharge listed as a separate line item.

Transmit Surcharge Data: Ensure your payment processing system sends the surcharge amount with the transaction for authorization.

Use compliant technology: Use a payment gateway to identify the card brand and type to ensure surcharges are applied only to eligible cards.

Penalties for non-compliance

The consequences of non-compliance can be severe. Acquirers may be fined US $1,000 for each merchant identified as having an improper surcharge, which is typically passed down to the merchant. Furthermore, acquirers’ merchant clients could face fines ranging from $50,000 to $1 million. Visa has intensified enforcement of merchant surcharges, so vigilance is key.

Should your business add surcharges?

Is surcharging right for you? That depends on your business, industry, and other local factors. You must consider whether it is prohibited in your area, what your competitors are doing, and the impact of adding a fee on your customers compared to the savings you would see by surcharging. If surcharging doesn’t fit your business well, consider dual pricing.

Dual pricing has an advertised price that includes the processing costs and a cash price that is typically 4% lower than the advertised price for paying with cash. Learn more about the differences between surcharging and dual pricing here.

Further Reading

Surcharging Vs Dual Pricing- What Small Business Owners Need to Know Now (2025)

Merchants Are Turning to Credit Card Surcharges J.D. Power Finds

About IntelliPay

We help merchants optimize their payment processing through transparent pricing, expert guidance, and reliable technology solutions. Our team combines deep industry knowledge with personalized service to ensure every client gets the best possible payment processing solution for their business.