Contents

- Updated December 2025

- Surcharging Basics

- Where Surcharging Is Allowed or Prohibited

- Core Surcharge Compliance Requirements

- Minnesota and Virginia – Updated Penalties

- Dual Pricing (Cash Discounting) Basics

- Why Dual Pricing Is Treated Differently From Surcharging

- State and Regulatory Considerations for Dual Pricing

- Common Compliance Mistakes to Avoid

- Choosing Between Surcharging and Dual Pricing

- How IntelliPay Can Help

Updated December 2025

With processing costs rising, many businesses are considering surcharging and dual pricing to offset credit card fees to protect shrinking margins. The challenge is doing it in a way that complies with card‑brand rules, evolving state laws, and new “junk fee” and price‑transparency rules, especially in states like California, Minnesota, and Virginia. This guide explains the key differences between surcharging and dual pricing, where each is allowed, and what you need for a compliant, low‑risk program in 2025.

Surcharging Basics

A surcharge is an extra fee added when a customer chooses to pay with a credit card; it cannot be applied to debit or prepaid cards under card‑brand rules. The purpose is to recover the cost of accepting credit cards, not to turn the surcharge itself into a profit center.

Key network limits in 2025 include:

- Visa: Cap of 3%, and it must not exceed your actual cost of acceptance (merchant discount rate) for that card.

- Mastercard, Discover, and Amex commonly allow up to 4%, subject to contracts and state limitations.

In all cases, merchants must follow whichever limit is lower: state law caps, card‑brand caps, or actual processing cost.

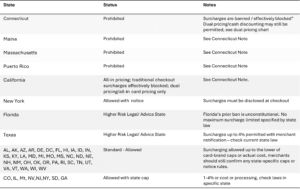

Where Surcharging Is Allowed or Prohibited

As of late 2025, credit card surcharging is legal in most of the U.S., though it remains heavily regulated or effectively off‑limits in a handful of jurisdictions.

- Entirely prohibited: Connecticut, Maine, Massachusetts, and Puerto Rico ban credit card surcharges under current statutes or case law, although they typically still allow properly structured cash discounts.

- California – all‑in pricing, not a pure “ban”: California’s SB 478 (“Honest Pricing Law”) requires that advertised or listed prices include all mandatory fees other than certain taxes and shipping. The California Attorney General has emphasized that businesses cannot advertise a lower price and then add mandatory fees at checkout, which effectively prohibits traditional “drip” checkout surcharges. Still, truly avoidable fees—like a credit card surcharge that cardholders can avoid by paying with cash or a debit card—may fall outside the scope of SB 478 if structured correctly. In practice, this pushes merchants toward dual pricing or all‑in card pricing rather than classic add‑on credit card surcharges in California.

- Legal with caps or special rules: States such as Colorado (2% cap), Minnesota (allows up to 5% in state law but practically capped by federal/card rules at 3–4%), Nevada (cost‑based caps), and others allow surcharging but restrict the amount and require specific disclosures and price‑transparency practices.

- New York: Allows surcharges but requires businesses to display the total credit card price, or both card and cash prices, before checkout; the surcharge cannot exceed the actual cost of acceptance, and penalties can reach $500 per violation under the surcharge statute.

Some states, such as Texas, have contested or evolving case law and enforcement positions, so merchants should not rely on outdated guidance. Merchants should confirm current requirements for all areas where they do business before launching a surcharge program.

Core Surcharge Compliance Requirements

Card brands and states share several common expectations for surcharging in 2025. To reduce risk, your surcharge program should:

- Apply only to credit card transactions, never to debit or prepaid card transactions.

- Stay within caps: not more than the lower of (1) your actual cost of acceptance, (2) the network cap (3% for Visa; usually 4% for others), or (3) any stricter state cap like Colorado’s 2%.

- Be disclosed clearly: signage at entrances and points of sale, and clear notice in online checkout flows, typically in at least 10‑point font and before the customer commits to pay.

- Show the surcharge as a separate line item on receipts and in the designated surcharge field in authorization and clearing messages.

- Be registered with your acquirer at least 30 days before starting; Visa generally requires notice to the acquirer, which then manages network registration.

- Treat comparable card brands consistently, following “honor all cards” and “honor all equal or higher cost brands” rules.

- Offer at least one no‑surcharge payment option, such as cash, check, or ACH, so cardholders have a reasonable way to avoid the fee.

Non‑compliance can result in card‑brand fines (which can escalate into high five or six figures for repeated or willful violations), state civil penalties, forced refunds, and loss of merchant accounts.

Minnesota and Virginia – Updated Penalties

Two states that now stand out for high penalty exposure are Minnesota and Virginia.

- Minnesota (HF 3438, effective January 1, 2025): Minnesota’s updated Deceptive Trade Practices Act requires that all mandatory fees be included in advertised prices unless consumers can reasonably avoid the fee (such as by paying cash). Surcharging remains legal if consumers can reasonably avoid the fee and if pricing is transparent. Still, violations of the new price‑transparency provisions can carry civil penalties of up to $25,000 per violation in enforcement actions by the Attorney General. Separate Minnesota guidance still references civil penalties of around $500 per violation in some surcharge contexts. Still, the key new risk driver is the up to $25,000 per‑violation cap under the Deceptive Trade Practices framework.

- Virginia (SB 1212, effective July 1, 2025): Virginia’s new surcharge law requires sellers to clearly and conspicuously display total prices, including all mandatory fees and any surcharges, in advertised prices. Non‑compliance can result in civil penalties of up to $2,500 per violation and up to $5,000 per subsequent violation under the Virginia Consumer Protection Act, and private plaintiffs can potentially recover up to $500 in damages per violation.

These higher state penalty ceilings make precise price‑transparency and signage practices especially important in Minnesota and Virginia.

Dual Pricing (Cash Discounting) Basics

Dual pricing—often referred to as cash discounting—presents two prices: a higher, card‑inclusive price and a lower price when customers pay with cash or other non‑card methods. At the federal level, discounts for cash or similar payment methods are permitted. Card networks allow properly structured dual pricing so long as pricing and signage are transparent, and the discount is genuine.

In a compliant program, the advertised or menu price is the card price, and the cash price is offered as a discount at the point of sale. For example, an item advertised at $104 as the card price may be discounted to $100 when the customer pays with cash, with the cash discount shown as a separate line on the receipt. This structure is fundamental in states with all‑in pricing rules because it prevents advertising a price lower than the amount a cardholder is actually required to pay.

Why Dual Pricing Is Treated Differently From Surcharging

Regulators and card brands treat dual pricing differently because it frames the difference as a discount from a card‑inclusive price, rather than as an add‑on fee to an advertised base price. When the posted price already includes card acceptance costs and the merchant reduces that cash price, there is no “hidden” or surprise fee added at checkout. By contrast, posting a lower cash price and then adding a fee only at checkout for card payments generally triggers surcharge rules. It may violate price‑transparency laws, especially in states like California and Minnesota.

To remain compliant and avoid being reclassified as surcharging, dual pricing programs must:

- Make the card price the default, advertised price across menus, shelves, and online listings.

- Disclose the cash discount clearly wherever prices are shown, not just at the register.

- Avoid ambiguous labels such as “non‑cash adjustment” where state or card‑brand guidance treats that structure as a surcharge or as a mandatory fee that must be baked into advertised prices.

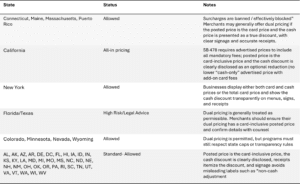

State and Regulatory Considerations for Dual Pricing

Dual pricing is generally legal in all 50 states when implemented as a genuine cash discount from a card‑inclusive price, but it must comply with consumer‑protection and advertising rules.

- California (SB 478): SB 478 bans “drip pricing” by requiring the advertised or listed price to include all mandatory charges, but it does not prohibit charges that are truly optional or avoidable. Because cardholders can avoid a credit card surcharge by choosing cash or debit, a carefully structured dual pricing program that posts card‑inclusive prices and offers a discount for cash is more compatible with California’s all‑in pricing model than a traditional add‑on surcharge.

- Minnesota: HF 3438 requires that mandatory fees be included in advertised prices and treats failures as deceptive trade practices; dual pricing satisfies this when the card‑inclusive price is advertised, and the cash discount is clearly framed as an optional reduction that consumers can choose by paying cash.

- Virginia: Senate Bill 1212 requires clear and conspicuous display of total prices, including surcharges and other mandatory fees; dual pricing remains permissible when card‑inclusive prices are advertised, and the discount is transparent.

- Wyoming: Unusually, Wyoming allows surcharges but explicitly caps cash discounts at 5%, so aggressive dual pricing programs must fit within this limit.

Given these variations, dual pricing often offers a more consistent, “all‑states” approach than surcharging, provided it is configured as a genuine cash discount from a card‑inclusive price.

Common Compliance Mistakes to Avoid

Whether using surcharging or dual pricing, many enforcement actions stem from a handful of recurring mistakes rather than sophisticated schemes.

Common issues include:

- Advertising only the lower cash price while effectively charging a higher price for the card without clear, upfront disclosure of the card price.

- Applying surcharges to debit or prepaid transactions, or exceeding caps set by state law or card‑brand rules.

- Using misleading labels—such as “technology fee” or “non‑cash adjustment”—for what are functionally surcharges, especially in states like New York and Minnesota that have detailed guidance and high penalty ceilings.

- Failing to show the fee or discount as a separate line on receipts or to configure POS systems properly so that card‑network data fields are accurate.

- Inconsistent staff explanations that confuse customers and generate complaints, negative reviews, or chargebacks.

Cleaning up signage, receipts, system configuration, and staff scripts goes a long way toward reducing this risk and demonstrating good‑faith compliance if questions arise.

Choosing Between Surcharging and Dual Pricing

Both surcharging and dual pricing can help recover card acceptance costs, but they have different legal, operational, and customer‑experience profiles.

Surcharging may make sense when:

- You operate mainly in states that clearly permit surcharges without all‑in pricing requirements that effectively prohibit add‑on fees.

- Your customers accept explicit card fees, and you can closely manage disclosure and caps.

- You are prepared to monitor state‑by‑state changes and card‑brand rules on an ongoing basis.

Dual pricing may be a better fit when:

- You want a model that works across all 50 states, including jurisdictions that restrict surcharges or require all‑in pricing, such as California and Minnesota.

- You prefer to frame the difference as a discount rather than a fee and align with “transparent pricing” expectations.

- You want simpler messaging for staff and customers while still significantly reducing processing costs.

For many small businesses, dual pricing offers a more flexible, customer‑friendly way to manage costs while staying on the right side of price‑transparency and “junk fee” enforcement trends. A carefully designed surcharge program can still be effective in the right states, but it generally demands tighter ongoing legal and network rule monitoring.

How IntelliPay Can Help

Given the mix of card‑brand rules, state statutes, and evolving enforcement, working with a provider that specializes in compliant surcharging and dual pricing is critical. A strong partner should supply compliant signage, up‑to‑date configuration templates, and staff training materials, along with technology that automatically applies correct fees or discounts, itemizes them on receipts, and keeps transaction data aligned with card‑network requirements.

IntelliPay offers surcharging and dual pricing solutions designed to follow card‑brand and state requirements, backed by experts who monitor changes—including all‑in pricing rules like California’s SB 478, Minnesota’s HF 3438, and Virginia’s SB 1212—and help merchants implement programs with confidence. To explore which approach is best for your business, contact an IntelliPay consultant at 855‑877‑6632 or visit https://intellipay.com/talk-to-a-consultant/.

This article is provided for general informational purposes only and does not constitute legal, tax, or accounting advice. Laws, regulations, and card‑brand rules regarding surcharging, dual pricing, and cash discounting change frequently and may vary by state, industry, and card network. Merchants should consult with qualified legal counsel and their payment processor or acquiring bank before implementing any surcharge or dual pricing program to ensure compliance with all applicable requirements.