Merchant Benefits of Financial Inclusion and eCash

Merchant benefits include adding customers and revenue from consumers who desire to make online payments but are hindered by the lack of a bank account or access to credit cards. In recent years, brining those who are Un or under banked into the financial mainstream has been defined as financial inclusion.

According to the World Bank:

“Financial inclusion means that individuals and businesses have access to useful and affordable financial products and services that meet their needs – transactions, payments, savings, credit and insurance – delivered in a responsible and sustainable way.”1

Unfortunately, financial inclusion is an issue for millions of Americans. According to a recent analysis by Morning Consult, a $1 billion market survey and consulting firm:

- One in 10 U.S. adults says they do not have a checking or savings account.

- Underbanked consumers are more likely to be men, while unbanked consumers are more likely to be women.

Who are the unbanked?

Unbanked adults are defined as those without a checking or savings account. An estimated 5.4 percent of U.S. households (approximately 7.1 million) were “unbanked” in 2019, meaning that no one in the household had a checking or savings account at a bank or credit union (i.e., bank).2

Of the 5.4%, half report that someone in their household does have a checking or savings account, and half report that no one in their household has either a checking or savings account, according to Morning Consult.

The underbanked

Underbanked refers to individuals or families who have a bank account but often rely on alternative financial services such as money orders, check-cashing services, and payday loans rather than on traditional loans and credit cards to manage their finances and fund purchases3

Specifically, underbanked individuals in Morning Consult’s survey were defined as having done at least 1 of 3 activities with a provider other than a bank or credit union in the past year: purchased a money order, paid bills, or cashed a check.

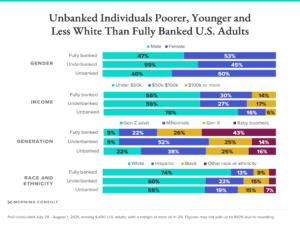

According to the Morning Consult analysis ,unbanked and underbanked adults are younger, poorer and less likely to identify as white when compared to fully banked consumers.

One notable difference between unbanked and underbanked consumers, however, is gender: Underbanked adults are more likely to be male, while unbanked adults are more likely to be female. Women are less likely than men to say that they participate “a lot” in the financial decisions of their household, and are more likely to cite someone else in their household having a bank account as a reason for their not having one, suggesting that they are not the primary financial decision maker in their household and use the bank account of whomever lives with them.

Source: Morning Consult

The demand for alternative payment methods

Being financially excluded, not having a bank account or card, has prevented many of the un(der) banked from easily accessing eCommerce and other forms of online transactions such as rent, utilities or loan payments.And yet there is a growing demand from these consumers to participate in the digital economy. One permanent impact of COVID-19 is that businesses that accept online payments should reassess the methods they offer in their online checkout. To grow their target customer base, adding new alternative payment options to serve un(der)banked and cash-reliant consumers seems reasonable.

For example, IntelliPay/paysafe eCash solutions enable consumers to initiate a transaction via an online checkout but then complete the process at a physical payment point with cash. This bridges the gap between the un(der)banked and digital commerce by enabling cash consumers to shop and transact online in a low cost and efficient manner, without having to change their preferred payment method.

According to Paysafe research, 47% of U.S. consumers would like to buy products online with cash if it was easy to do so and 43% agreed that they would shop online more regularly if paying with cash was available. These consumers that either cannot, or do not want to, make online payments using other methods such as credit cards, could prove to be a huge target market for businesses in the U.S. in the coming years as we begin to recover from the financial impact of the pandemic. 4

“All merchants can benefit from new customers and revenue by offering eCash as a payment option to their customers.” said Casey Leloux, CEO of Payment Services Provider, IntelliPay. “With over 60,000 US retail locations, eCash is available to anyone with easy access to a gas station, convenience store, pharmacy, or dollar/discount retailer,” added Leloux. For more information on each, visit www.intellipay.com/ecash.

1- https://www.worldbank.org/en/topic/financialinclusion/overview#1

3 – https://www.investopedia.com/terms/u/underbanked.asp

5 https://obamawhitehouse.archives.gov/blog/2016/06/10/financial-inclusion-united-states