Merchant Solutions

Simplify Payments, Pay Less

IntelliPay’s platform eliminates complexity and immediately cuts your total cost of acceptance. Our centralized admin console grants your team full control to instantly provision users, deploy features, and manage all payment models.

By leveraging compliant, fee-based options, we shift processing costs directly to the consumer, protecting your margins.

IntelliPay Payment Processing

Virtual Terminals

Browser based EMV for in-person and over-the-phone payments

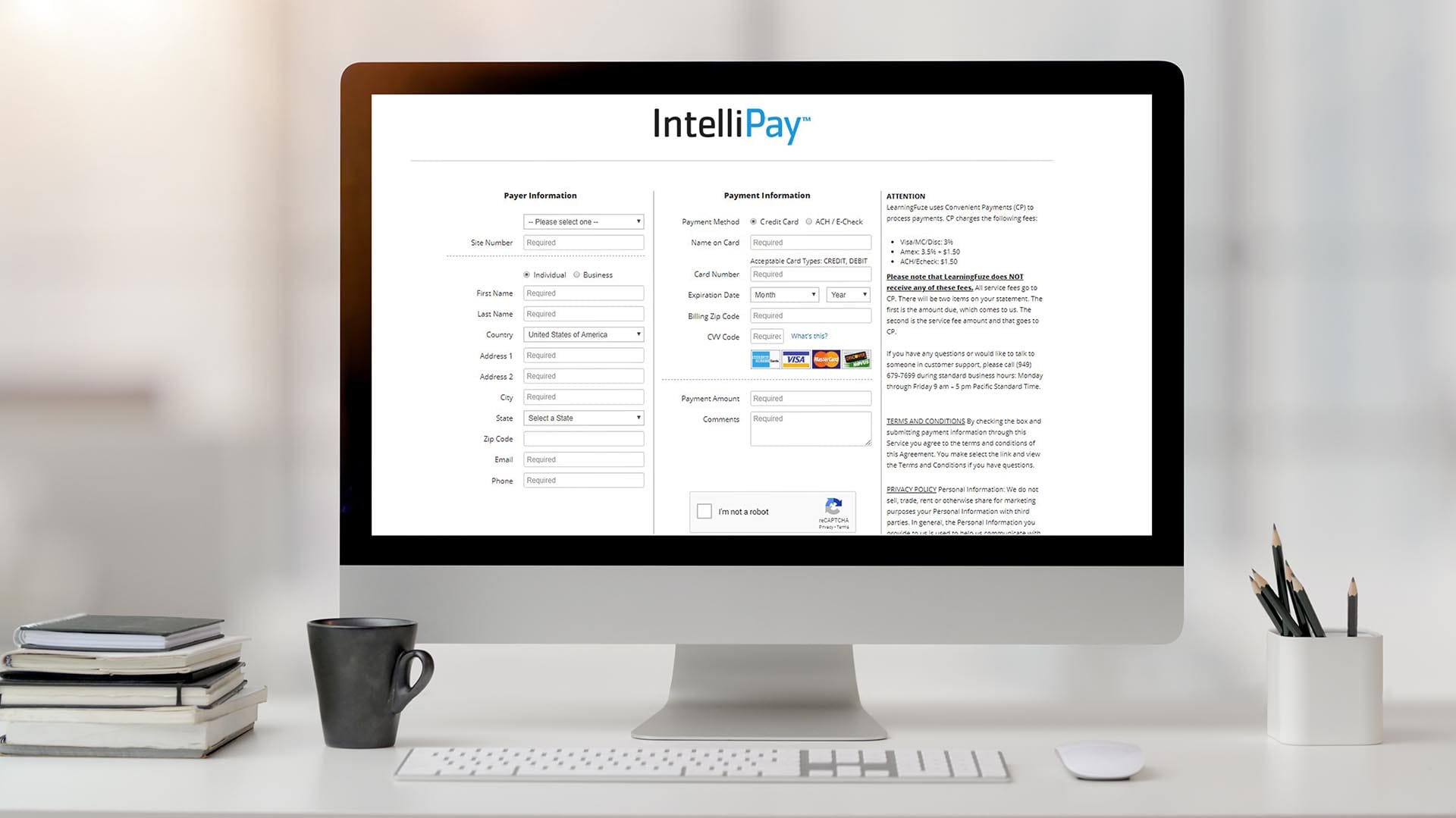

Online Payment Page

Add to any website and customize for secure checkouts and donations

Customer Portals

Cross device compatibility with built-in wallet and multi-invoice payment capabilities

Lightbox Modal

Pop-up modals that allow secure payments from existing invoice pages

Text to Pay/Email Payments

Create and securely send on-demand payment link with custom messages

Mobile App

iOS and Android app makes accepting payments in the wherever you go easy

Batch Processing

Process many transactions and securely upload payment data all at one time

Reduced Cost Options

Add to any website and customize for secure checkouts and donations

Robust Reporting

Detailed reports simplify reconciliations and payment management

Custom Fields

Fields can be customized to the way you do business

Recurring Payments & Auto Pay

Increase efficiency and reduce late payments with automated billing

Safe & Secure

Tokenization, encryption and other secure technologies safeguard sensitive payment data<

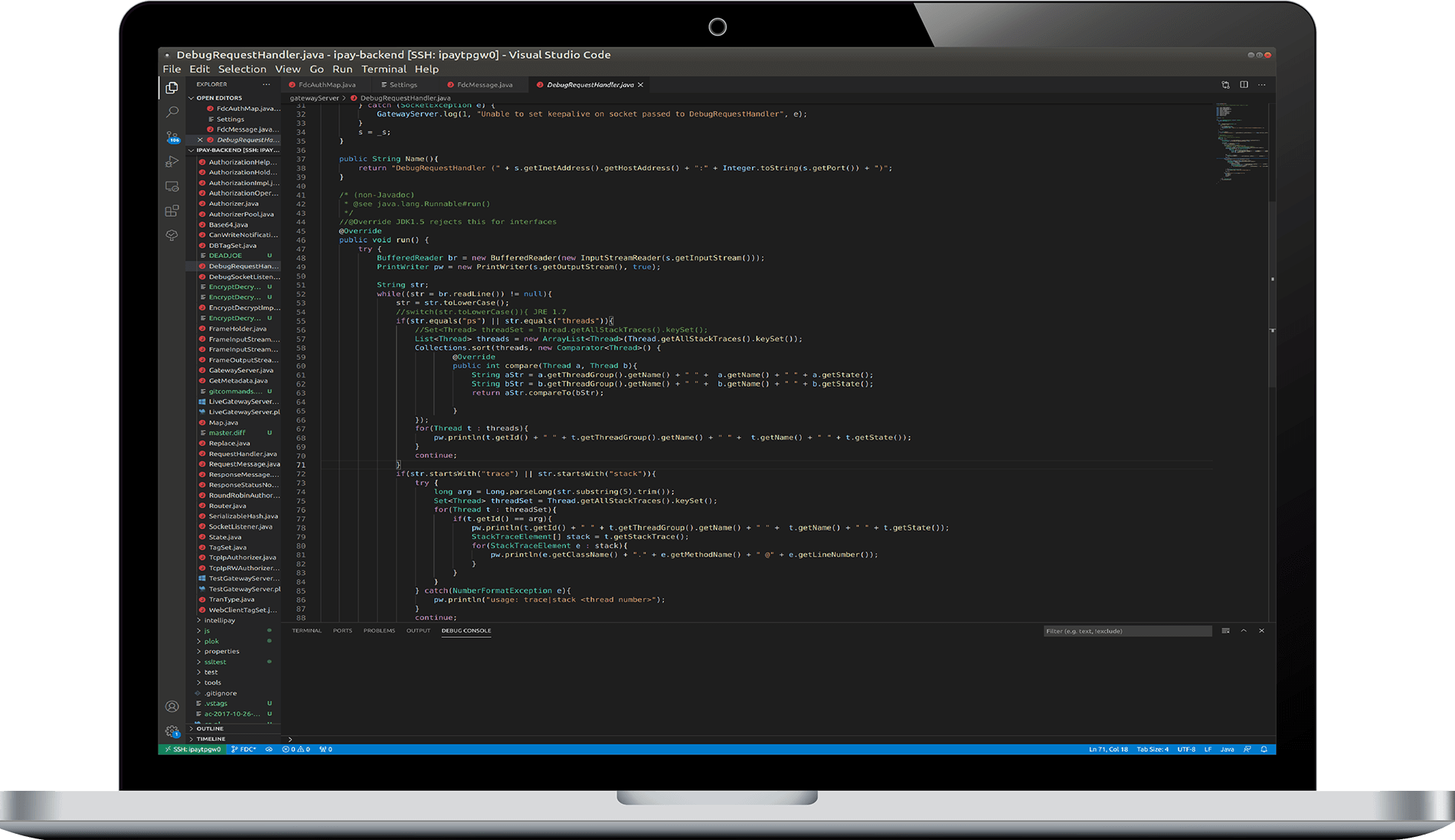

PaymentAPIs

Our development team has created powerful, easy-to-use APIs so you won’t spend months integrating payments into your environment.

Prebuilt integrations

Use integrations for QuickBooks Online, Woo Commerce and Auth.NET emulator to connect third- party shopping carts or CRMs.

PaymentSavings

Visa, Mastercard, Amex, and Discover charge mandatory, non-negotiable interchange fees to manage the risk involved in a transaction.

Riskier online transactions completed with rewards credit cards have the highest fees, usually about 2X the cost of debit cards. But there are ways to minimize or eliminate fees and save your margins.

IntelliPay offers:

- Interchange plus pricing (Interchange fee plus small mark-up)

- Auto-filled Level 2 and 3 data

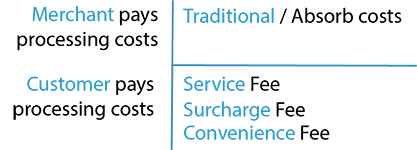

- The customer pays the processing costs (fee-based options)

- No junk fees

Service& Transparency

Switching payment processors should eliminate your current headaches.

Dedicated support you can count on

Payment issues can stop your business cold. That’s why we invest in responsive, personalized service:

U.S.-Based Support: Access our knowledgeable, in-house support team via phone and chat.

Dedicated Account Manager: For qualifying accounts, you will be assigned a specific account manager who knows your business, eliminating the frustration of calling a random 1-800 number.

Quick Issue Resolution: Our team is trained to resolve issues quickly, ensuring continuity during peak sales periods.

Transparent & Simple

Simple Onboarding: Our activation specialists ensure a seamless setup.

No Equipment Leasing: We offer terminals and hardware for purchase, eliminating equipment lease traps common among processors.

- No Junk Fees: We don’t charge fees for custom branding, ACH processing, or next business day funding.

Fee-Based Options

Charging a customer a fee for using a high-cost credit card is not illegal or unethical.

Customers choose a rewards card to get the travel perks or cash back at your expense. Which is not fair!

Level the playing field with 100% compliant fee-based options that reduce a merchant’s processing costs.

FAQs

Q: What exactly does "No Cost Payment Solution" mean?

A. No Cost” refers to our Fee-Based Options, where the mandatory processing fees are passed to the customer who chooses to pay using a high-cost method, such as a credit card. This is done through compliant surcharging, eliminating the cost burden for your business and protecting your margin

Q: How is IntelliPay's pricing different from Flat-Rate Processors (like Square/Stripe)?

A. We offer Interchange-Plus Pricing (Interchange fee plus a small, fixed markup). This is the most transparent model and is typically the cheapest option for high-volume merchants and those processing large transactions, unlike flat-rate models where you often overpay for lower-cost debit card transactions.

Q. Are your fee-based options (surcharging) legal and compliant?

A. Yes. Our fee-based options are 100% compliant with all relevant card network rules and state laws. Our system handles the complex disclosure and fee calculation requirements automatically, ensuring your business stays compliant without effort.

Q. How secure is the IntelliPay platform?

A. IntelliPay is a PCI DSS Level 1 certified processor. We use tokenization, encryption, and other secure technologies to handle all sensitive cardholder data on our secure servers, minimizing your PCI compliance scope and safeguarding your business against fraud.

Q: Can IntelliPay integrate with my existing POS or accounting software

A. Yes. We offer multiple integration methods, including a powerful RESTful API for custom builds and pre-built integrations for popular platforms like QuickBooks Online and WooCommerce, eliminating manual data entry and simplifying reconciliation